Get the free oklahoma form 513

Show details

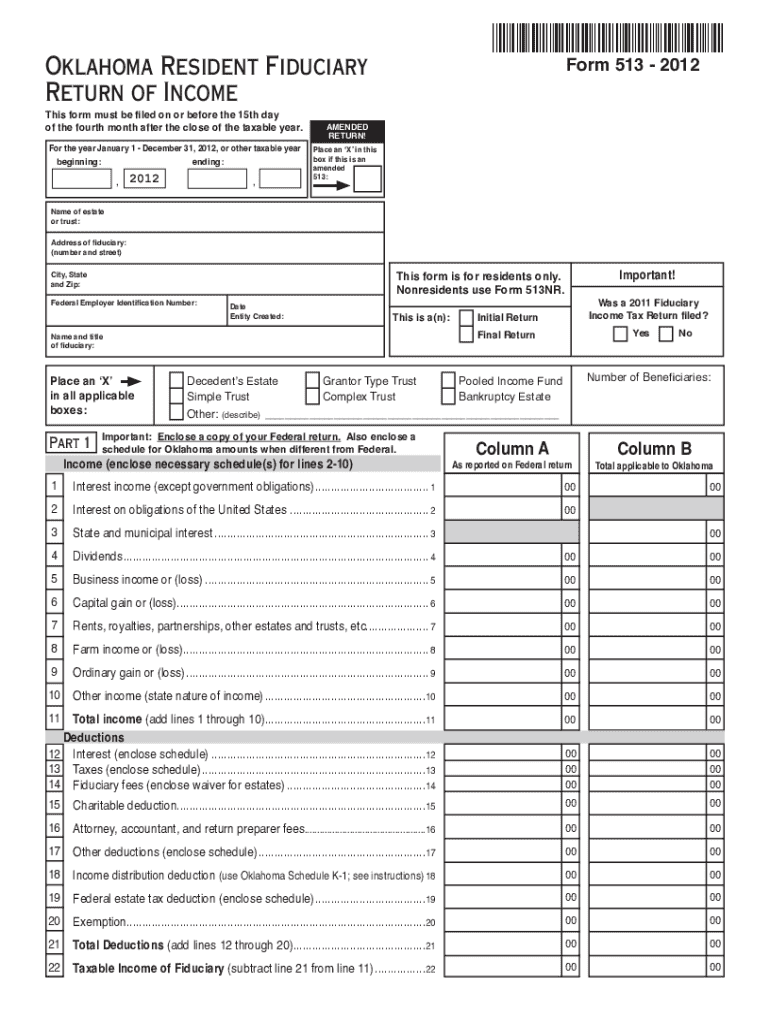

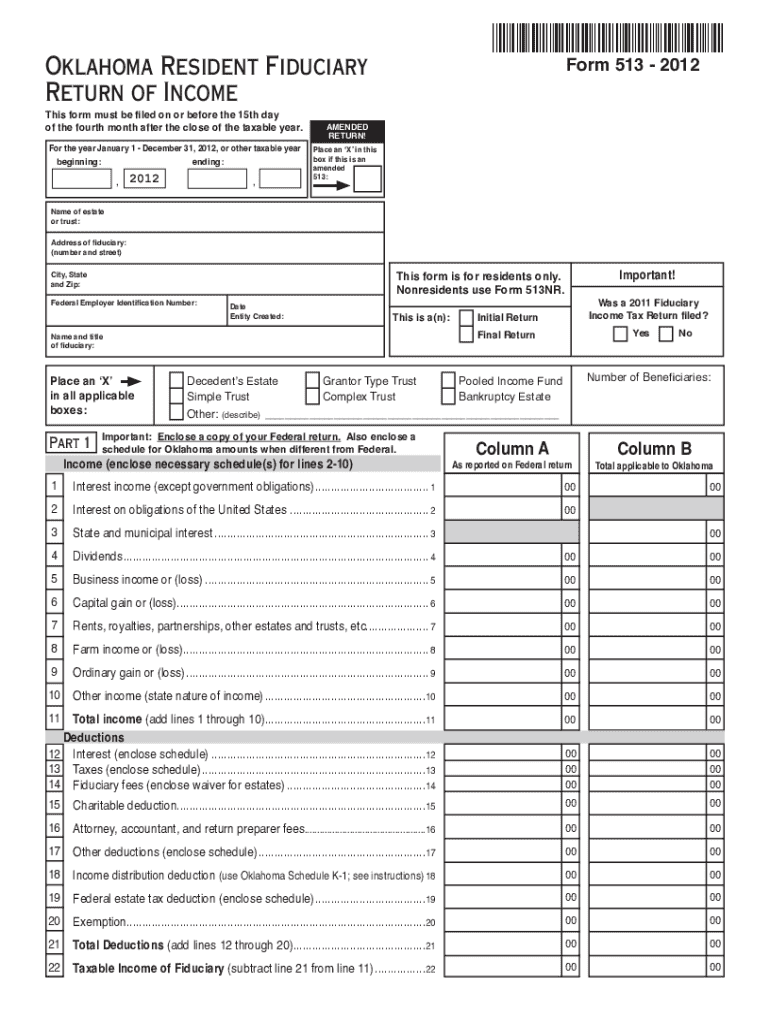

Includes Form 513 2012 Oklahoma Resident Fiduciary Income Tax Forms and Instructions This packet contains: Instructions for completing the Form 513 513 fiduciary income tax form 2012 fiduciary income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma trust filing requirements form

Edit your oklahoma form 513 instructions 2022 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma form 513nr instructions 2022 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

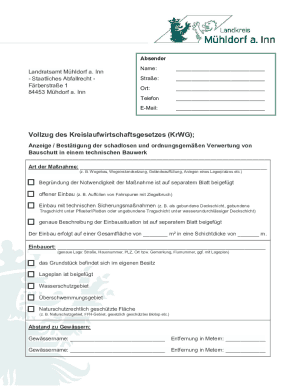

Editing ok form 513 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oklahoma tax form 513. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

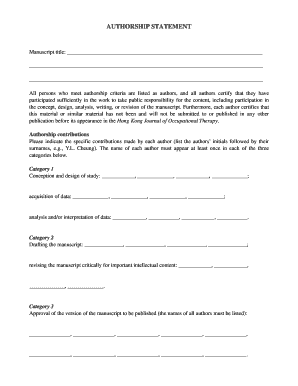

How to fill out oklahoma fiduciary income tax return form

How to fill out Oklahoma form 513:

01

Gather all relevant information: Before starting to fill out Oklahoma form 513, make sure you have all the necessary information handy. This includes your personal details such as name, address, social security number, and employer information, as well as any applicable tax documents.

02

Follow the instructions: The form 513 comes with accompanying instructions that provide step-by-step guidance on how to complete each section. Carefully read and follow these instructions to ensure accurate and timely completion of the form.

03

Provide personal information: Begin by entering your personal information in the designated fields. This includes your name, address, and social security number. Double-check the accuracy of these details before moving on.

04

Report income: Oklahoma form 513 requires you to report all sources of income earned during the tax year. Use the provided sections to enter details such as wages, interest, dividends, self-employment income, rental income, and any other applicable sources. Consult your tax documents, such as W-2s and 1099s, to accurately report your income.

05

Deductions and credits: Oklahoma form 513 allows for various deductions and credits that can help reduce your tax liability. If applicable, provide the necessary information and documentation to claim these deductions and credits. Examples may include deductions for mortgage interest, charitable contributions, or educational expenses.

06

Calculate and report tax liability: Once you have entered all the necessary information, use the provided calculations or tax tables to determine your tax liability. Be sure to double-check your calculations for accuracy.

07

Sign and date: Once you have completed all sections of the form, sign and date it. If you are filing jointly, ensure that your spouse also signs the form.

Who needs Oklahoma form 513:

01

Individuals who are residents of Oklahoma and have a filing requirement for state income tax are required to fill out form 513.

02

Oklahoma form 513 is specifically designed for those who need to report their income, deductions, and tax liability for the tax year in question.

03

This form may also be necessary for individuals who have received income from Oklahoma sources, even if they are not residents of the state.

Fill

form

: Try Risk Free

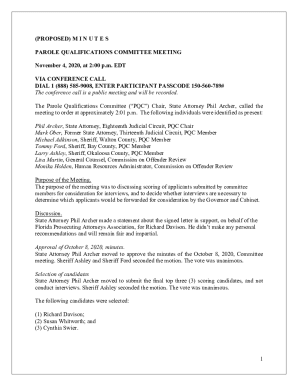

People Also Ask about

Do I have to file Oklahoma tax return for gambling winnings?

You might then ask are gambling winnings considered “Oklahoma source gross income”? The answer is yes, income received from all sources of “wagering games of chance or any other winnings from sources withing Oklahoma” are taxable.

Does an LLC have to file an Oklahoma franchise tax return?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

What happens when a tax warrant is issued Oklahoma?

A tax warrant that is directed to a county sheriff commands the sheriff to levy upon and sell, without any appraisement or valuation, any of the taxpayer's real or personal property within the county for the payment of the delinquent tax, plus any interest and penalties, as well as the cost of executing the warrant.

How do I stop a tax warrant in Oklahoma?

Oklahoma Warrants for Unpaid Taxes Once a warrant has been attached to your property, you will not be able to sell or take loans out against the property. To get the lien removed, you must pay the tax, interest, and penalties in full.

What is Oklahoma Form 513?

Oklahoma Form 513 is an individual income tax return form used by residents of Oklahoma to report their taxable income to the Oklahoma Tax Commission. It is used to calculate and report the amount of taxes owed to the state.

Can you go to jail for a tax warrant in Oklahoma?

A tax warrant equals a tax lien. Thankfully, a tax warrant differs from an arrest warrant. Unless you committed blatant tax fraud, you can probably breathe easy!

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

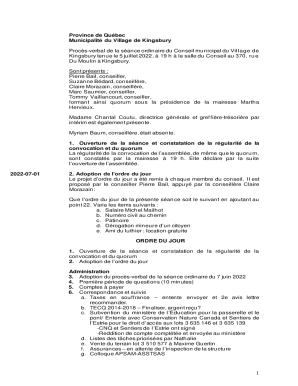

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file oklahoma form 513?

Oklahoma Form 513, Nonresident and Part-Year Resident Income Tax Return, must be filed by any nonresident or part-year resident of Oklahoma who has earned income from Oklahoma sources.

What is the purpose of oklahoma form 513?

Oklahoma Form 513 is an individual income tax return form used by residents of Oklahoma to report their taxable income to the Oklahoma Tax Commission. It is used to calculate and report the amount of taxes owed to the state.

What information must be reported on oklahoma form 513?

Oklahoma Form 513 is an annual tax return filed with the Oklahoma Tax Commission. The form requires taxpayers to report their gross income and their deductions, including federal income tax deductions, state income tax deductions, local income tax deductions, and charitable contributions. Taxpayers must also report any Oklahoma income tax credits they have claimed. In addition, the form requires taxpayers to report their total Oklahoma income tax due, as well as any estimated payments made during the year.

What is oklahoma form 513?

Oklahoma Form 513 is a tax form used by residents of Oklahoma to calculate and pay estimated individual income tax. It is specifically used for individuals who do not have enough taxes withheld from their wages or salaries to cover the yearly tax liability. The form helps taxpayers determine the amount they need to pay in estimated tax throughout the year to avoid penalties and interest.

Can I create an electronic signature for signing my oklahoma form 513 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your oklahoma form 513 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit oklahoma form 513 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing oklahoma form 513.

How do I edit oklahoma form 513 on an Android device?

You can make any changes to PDF files, like oklahoma form 513, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your oklahoma form 513 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Form 513 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.